Surplus value

Optimal strategy

Surplus release

pensions:

assessing the value of DB scheme run-on

Executive summary

For the past two decades, Defined Benefit (DB) pension schemes have largely been a significant financial burden for companies, with billions of pounds of deficit contributions paid in to stem ever-worsening deficits. But the turnaround in financial position and the emergence of significant surpluses has fundamentally changed the economic potential of these schemes.

This has not escaped the attention of the government, whose 2025 Pension Schemes Bill is aiming to simplify the process for releasing DB scheme surpluses for the benefit of companies and members (and ultimately the wider economy through tax receipts and private capital investment).

But exactly how much economic value is there in these DB schemes? And how should companies be assessing the optimal strategy for surplus extraction? Is surplus best accessed via an immediate buyout or would running on for a period result in an enhanced risk-adjusted return?

In this analysis of the DB pension schemes of the FTSE 350 companies, we examine how much value they could obtain from their schemes and outline our assessment of the likely optimal strategies for the different FTSE 350 companies.

Lewys Curteis,

Partner and Corporate Actuary

Surplus release: funding level safeguard

One of the key issues addressed in the government's Pension Schemes Bill 2025 is the funding measure beyond which it's deemed to be safe to extract surplus.

Current legislation permits surplus payments only where the scheme assets exceed the buyout funding level, but the government is intending to reduce this threshold to reflect a low dependency funding level.

This reduction in funding threshold should theoretically broaden the scope for surplus extraction. The chart on the right shows the current estimated aggregate surplus of the FTSE 350 schemes on a buyout basis and low dependency basis.

This analysis shows the surplus that could potentially be immediately accessed from the FTSE 350 schemes - approximately £67bn based on a low dependency funding threshold and £29bn based on a buyout funding threshold. However, it's worth noting that these surplus amounts are expected to increase over time, making running on for a period of time the right strategy for some companies. This is expected because of the combination of:

Despite the government's intention to set the surplus extraction threshold based on a low dependency funding level, we expect the debate on what constitutes a 'safe' level of funding for surplus release to continue for individual schemes.

In our view, it will be difficult for trustees to justify releasing surplus funds to the sponsoring employer where the scheme assets are below a buyout funding level, unless there's a very high degree of confidence in the employer covenant and/or a very comprehensive security package is offered.

Further, there's an interplay between the surplus release basis and the proportion of surplus that is likely to have to be shared with members.

Using a weaker basis - such as low dependency - may mean a greater proportion of the surplus needs to be shared with members to compensate for the greater reduction in benefit security. Once it's recognised that a weaker basis does not increase the quantum of surplus that can be ultimately released - it merely accelerates it - it would seem logical for sponsors to prefer a stronger buy-out test, where the eventual benefit will be greater. This obviously needs to be balanced with the sponsor's preference for the value to be released sooner rather than later.

expected asset returns exceeding liability discount rates;

the unwinding of actuarial prudence;

the effect of member options; and

scheme maturing effects.

Assessing the optimal strategy

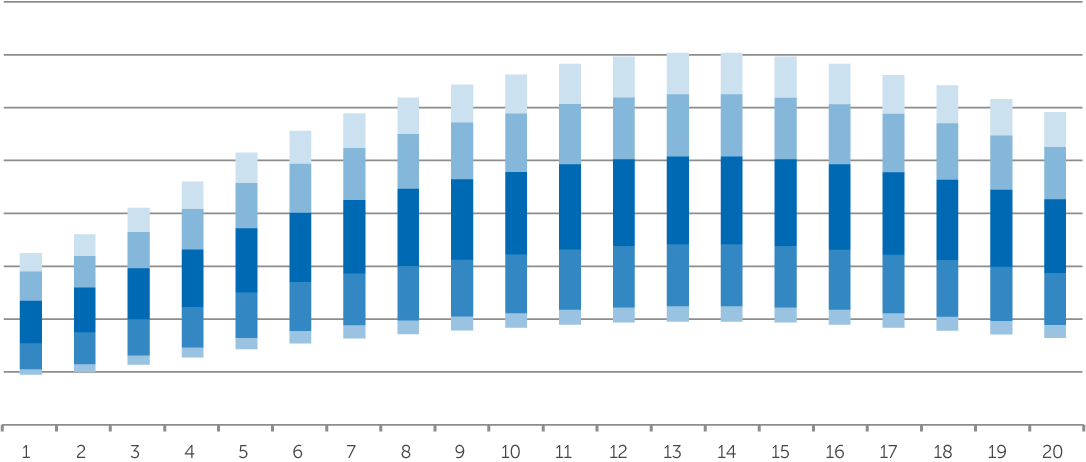

For a company considering the relative merits of running on versus an immediate buyout, the surplus that might be realisable in each future year needs to be assessed.

This will involve a stochastic projection of the scheme's funding level on the agreed surplus extraction basis to estimate future surplus levels. An adjustment should then be made for any surplus expected to be shared with scheme members and any tax expected to be paid for direct surplus refunds to the employer.

On the other side of the equation, the running costs of the scheme in each future year should be estimated - this can include corporate management time.

The net present value of extracting surplus can then be determined for each future year, with surplus refunds discounted based on a risk-adjusted cost of capital (reflecting the potential volatility in surplus amounts) and running costs discounted based on the employer's ordinary cost of capital (reflecting the more fixed nature of these payments).

The financially optimal strategy is the strategy that maximises the net present value for the employer.

VIEW CHART

The optimal strategy for the FTSE 350 companies

To identify the strategies that will likely maximise economic value for the different FTSE 350 companies, we have undertaken a simplified version of the above method based on a deterministic projection of scheme funding levels.

We have assumed that surplus will only be extracted where the scheme asset value exceeds the buyout liabilities (as we think this will be the most likely circumstance in which this will occur).

A brief description of the calculation method:

We have estimated buyout funding levels by approximately adjusting the asset and liability values disclosed in corporate accounts.

We have projected future asset and buyout liability values, making allowance for expected future benefit payments, expected future administration costs and the expected impact of scheme maturing.

We have assumed a scheme's existing investment strategy and deficit contributions continue until buyout funding is reached, at which point deficit contributions cease and a gilts +1% p.a. asset return strategy is adopted.

We have assumed 80% of the surplus is allocated to the employer and this is paid directly from the scheme to the employer (making allowance for tax liabilities).

We have assumed that 100% of the surplus above the buyout funding measure is paid out once it has been generated (in practice, employers and trustees are likely to smooth the payment of surplus to some degree).

We have generated a model of administration expenses that varies by scheme size, based on publicly available information relating to scheme expenses.

We have assumed that surplus payments are discounted by companies at a rate of gilts +7% p.a., with expense payments discounted at a rate of gilts +3.5% p.a.

We have then calculated the net present value of the surplus refunds to the company, assuming a scheme buyout occurs after varying periods of run-on (including the scenario where buyout occurs immediately).

This analysis is based only on publicly available information - primarily from company accounts - so it's necessarily approximate, and a different conclusion might be reached based on a detailed analysis with full company and scheme information.

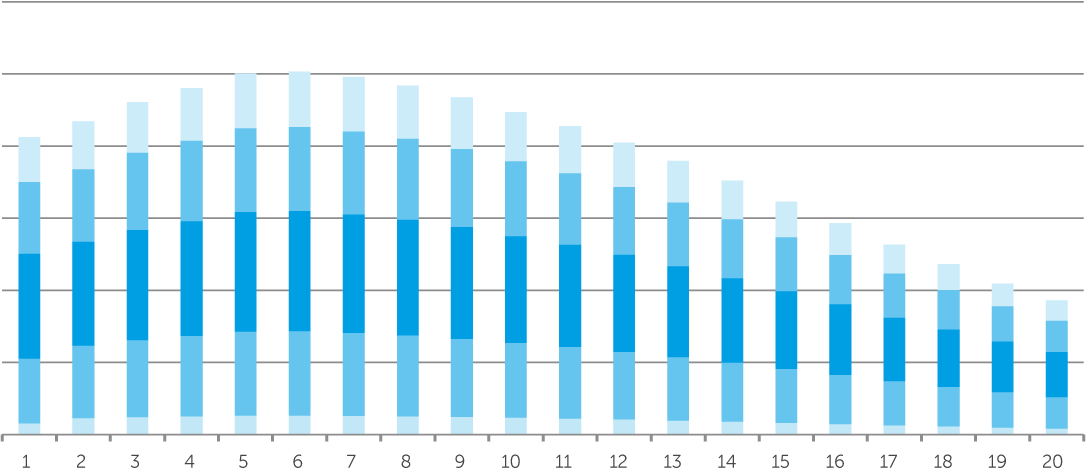

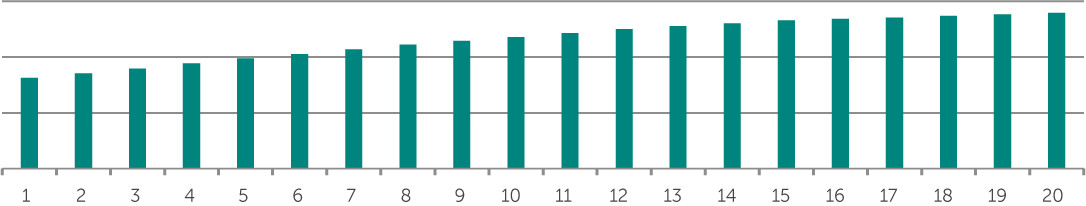

The chart below sets out our assessment of the optimal strategy for the different FTSE 350 schemes once full funding on a buyout basis is achieved.

Our analysis shows that an immediate buyout would be the optimal strategy for 33% of FTSE 350 companies. This is mainly due to administration expenses depreciating the value that could be obtained from surplus refunds - either due to the relatively low value of the scheme's existing assets or the scheme assets being relatively small by the time full funding on a buyout basis is reached.

For the remaining 67% of the companies, the net present value is maximised from running on for a period of time to generate additional surplus. The average period of time to maximise the net present value for this cohort of companies is 10 years, with the period of run-on broadly increasing with scheme size, as illustrated in the chart below.

For this group of companies, running on for a period of time after buyout funding has been reached increases the value of the surplus extracted by around 20%, from £17bn to £20bn.

The FTSE 350 DB schemes account for around a third of the UK DB universe by asset size, so scaling up the £20bn amount suggests the value of DB scheme surpluses could be around £60bn for sponsoring employers should they pursue the optimal financial strategy.

Clearly, the choice of strategy for a company will ultimately depend on a broader set of factors beyond the pure financials of the underlying pension scheme - such as corporate expertise, risk appetite, and wider business plans - but this analysis does show that there's an active decision to be made in terms of the best strategy to adopt.

Materiality of surplus extraction

In this final section, we consider the potential significance of accessing DB scheme surplus for the individual FTSE 350 companies. Put simply: is the potential surplus return financially material in the context of the sponsor's overall business?

For some companies, whilst one strategy may appear financially optimal over another, it's unlikely to have a material impact on the business's prospects, or its share price today. On the other hand, for some companies the decision of whether to buyout or run-on could be something that management and shareholders should be intently focussed upon.

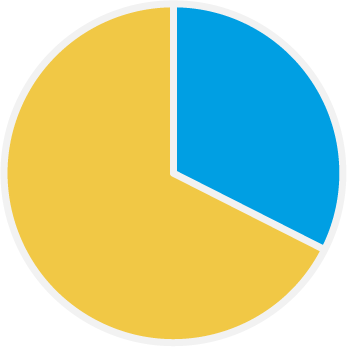

For the companies where we have identified running on as the optimal strategy, we have shown in the chart on the right how the net present value of the surplus return compares to each company's market capitalisation.

FTSE 350 aggregate surplus

Buyout basis

Low dependency basis

0

10

20

30

40

50

60

70

80

£bn

£67bn

£29bn

Year

5% - 10%

10% - 25%

25% - 75%

75% - 90%

90% - 95%

5% - 10%

10% - 25%

25% - 75%

75% - 90%

90% - 95%

Projected surplus

Annual expenses

Net present value of surplus extraction

Annual expenses

Buyout vs run-on

100%

£0-�£50m

Optimal strategy by size of scheme

80%

60%

40%

20%

0%

£50m-�£200m

£200m-�£500m

£500m-�£2bn

£2bn+

50%

50%

68%

32%

88%

12%

94%

6%

100%

33%

67%

Buyout

Run-on

Optimal run-on period

20

15

10

5

0

0

0.5

1

1.5

2

Size of scheme assets (£bn)

Optimal run-on period (years)

0%

10%

20%

30%

40%

50%

60%

70%

80%

8.9%

Surplus value as a percentage of market capitalisation

90%

100%

10.5%

13.4%

67.2%

Over 5%

Over 2%

Over 1%

Under 1%

This analysis shows that the potential value of the DB scheme surplus is relatively small compared to the market capitalisation for the majority of companies. However, for around 10% of companies the value of surplus relative to market capitalisation exceeds 5%. This threshold would seem to indicate that getting this decision right or wrong could materially impact the company's valuation.

The chart below shows how the annual surplus release over the optimal run-on period for these companies compares to the three-year average of pre-tax profits.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Annual surplus release as a percentage of three-year average pre-tax profits

Over 50%

Over 10%

Over 5%

Under 5%

3%

9%

15%

73%

Again, the analysis demonstrates that the surplus available for extraction is potentially material for some companies, with the annual surplus release (over an average run-on period of 10 years) exceeding 10% of pre-tax profits for 12% of the companies where running on has been identified as the optimal strategy.

Surplus value: material for some

Overall, for the majority of the FTSE 350 companies, the potential surplus return is relatively small compared to the size of the company. However, for a number of companies the potential surplus return is material and could significantly impact the company's finances. This cohort of companies could quite plausibly be undervalued if investors are not considering the potential value that could be obtained from the DB scheme surplus - an important reminder for analysts that the corporate accounting position may not be the best reflection of the value of the DB scheme to the company.

Calculation details

The data used for this analysis has been collected from the accounts of FTSE 350 companies for their 2024 year ends (i.e. up to and including the year ending 31 December 2024). Liability values on a buyout basis have been estimated by approximately updating these results and using Barnett Waddingham's view of average buyout pricing. Asset values have been estimated using index returns and the asset split disclosed in the pension disclosures.

Lewys Curteis FIA CERA

Partner and Corporate Actuary

Email Lewys

Call Lewys

Email Lewys

Call Lewys

Key contacts

Return to top

Copyright © Barnett Waddingham 2025

Manage preferences

SIGN UP NOW

Stay ahead with our latest comment, expert insight and event notifications

SIGN UP FOR EMAIL UPDATES

FOLLOW US

Accessibility

Consumer duty

Data management

Diversity, equity and inclusion

Legal notices

Privacy

Sitemap

Slavery and human trafficking

FURTHER READING

Ian Mills BSc FIA

Partner and Head of DB Endgame Strategy

Email Ian

Call Ian

Email Ian

Call Ian

Net present value of surplus extraction

benefit from running on

For

DB surplus is materially significant

Insights

Expertise

About us

People

Return to top

Copyright © Barnett Waddingham 2025

Manage preferences

SIGN UP NOW

Stay ahead with our latest comment, expert insight and event notifications

SIGN UP FOR EMAIL UPDATES

FOLLOW US

Accessibility

Consumer duty

Data management

Diversity, equity and inclusion

Legal notices

Privacy

Sitemap

Slavery and human trafficking

FURTHER READING